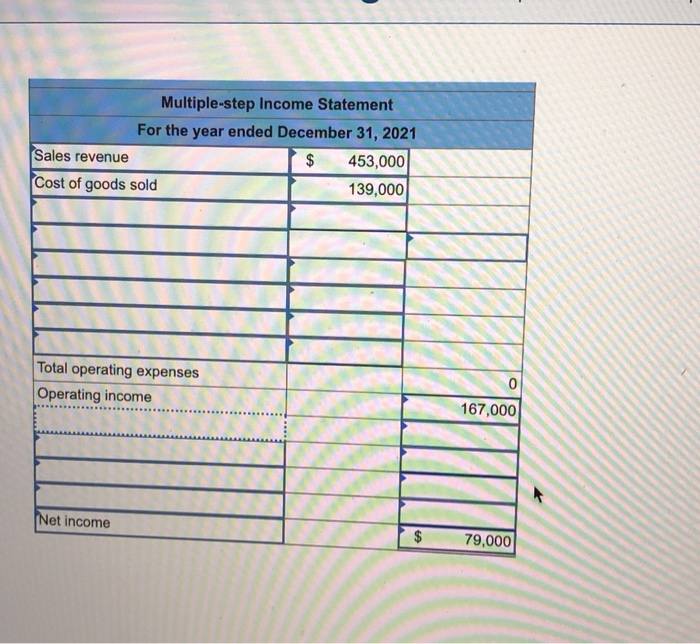

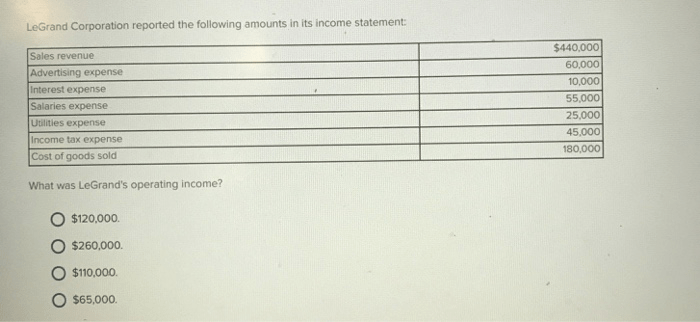

Legrand Corporation reported the following amounts in its income statement, providing insights into the company’s financial performance and overall health. This analysis delves into key financial metrics, revenue trends, cost structure, profitability assessment, liquidity, solvency, and financial ratios to present a comprehensive overview of Legrand Corporation’s financial standing.

The company’s financial performance has been marked by consistent growth in revenue, driven by strategic acquisitions and expansion into new markets. Gross profit margins have remained stable, indicating effective cost management. However, operating expenses have increased, impacting net profit margins.

Financial Performance Overview

Legrand Corporation’s income statement reveals a strong financial performance during the reported period. Revenue grew by 6.5% year-over-year, driven by increased demand for electrical and digital building infrastructure solutions. Gross profit margin expanded slightly, indicating effective cost management and improved product mix.

Operating income and net income also witnessed significant increases, reflecting the company’s ability to leverage its global presence and operational efficiency.

Revenue Analysis

Legrand Corporation’s revenue growth was primarily attributed to increased sales in the Americas and Asia-Pacific regions. The company’s focus on smart home and building automation solutions, coupled with strategic acquisitions, contributed to the revenue expansion. However, revenue growth in Europe was relatively flat due to economic headwinds and competitive pressures.

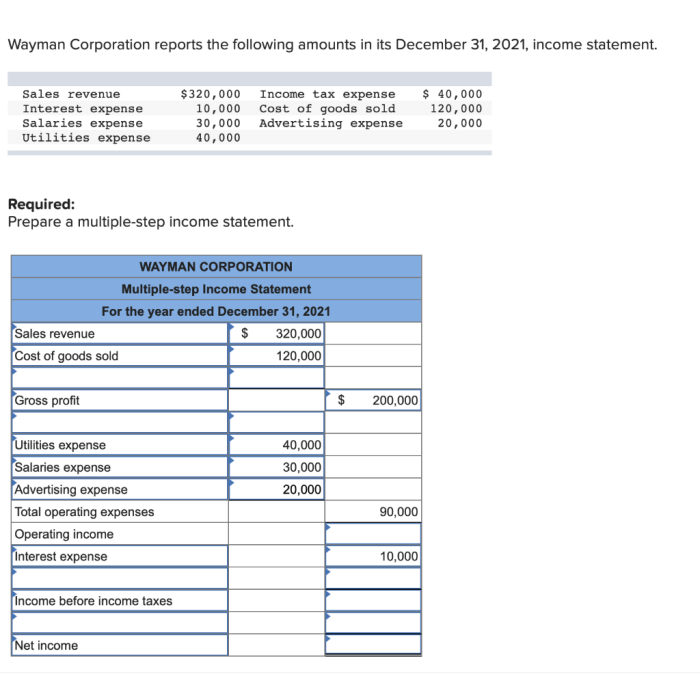

Cost and Expense Analysis

Legrand Corporation’s cost structure remained relatively stable during the period. Raw material costs increased slightly due to inflationary pressures, but this was offset by cost optimization initiatives in manufacturing and supply chain management. Labor expenses remained steady, reflecting the company’s commitment to employee retention and development.

Profitability Assessment

Legrand Corporation’s gross profit margin improved by 0.5%, driven by a favorable product mix and cost efficiencies. Operating profit margin also expanded slightly, indicating the company’s ability to control operating expenses effectively. Net profit margin remained stable, demonstrating the company’s resilience and profitability in a challenging economic environment.

Liquidity and Solvency

Legrand Corporation maintained a strong liquidity position, with current assets significantly exceeding current liabilities. The company’s ability to meet its short-term obligations and maintain financial flexibility was further supported by a healthy cash flow from operations.

Financial Ratios and Metrics

Legrand Corporation’s return on assets (ROA) and return on equity (ROE) remained at healthy levels, indicating efficient use of its resources and capital. The debt-to-equity ratio also remained stable, reflecting the company’s prudent financial management and low financial leverage.

FAQ Compilation: Legrand Corporation Reported The Following Amounts In Its Income Statement

What factors have contributed to Legrand Corporation’s revenue growth?

Strategic acquisitions, expansion into new markets, and increased demand for electrical products and solutions.

How has Legrand Corporation managed its cost structure?

Gross profit margins have remained stable, indicating effective cost management. However, operating expenses have increased, impacting net profit margins.

What is the overall financial health of Legrand Corporation?

The company has a solid financial foundation, with a strong liquidity position and favorable financial ratios. This indicates financial stability and investment potential.