Suppose your expectations regarding the stock market are as follows: the market will continue to rise, driven by strong economic growth and low interest rates. This expectation is based on a number of factors, including the recent performance of the stock market, the current economic climate, and the expectations of other investors.

However, it is important to remember that the stock market is a complex and unpredictable system, and there is no guarantee that your expectations will be met.

In this guide, we will discuss the factors that influence expectations for the stock market, the risks and uncertainties associated with investing in the stock market, and the strategies that investors can use to manage risk and mitigate uncertainty. We will also discuss the ethical implications of using expectations to guide investment decisions.

Market Expectations

The stock market is a complex and dynamic system, and predicting its future performance is a challenging task. However, investors can make informed decisions by considering market expectations, which reflect the collective beliefs of market participants about the future direction of stock prices.

Market expectations are influenced by a variety of factors, including economic conditions, corporate earnings, and geopolitical events.

Factors Influencing Expectations

Key factors that influence market expectations include:

- Economic Conditions:Economic growth, inflation, and interest rates are major factors that affect market expectations. Strong economic growth typically leads to higher stock prices, while high inflation and interest rates can negatively impact market performance.

- Corporate Earnings:Corporate earnings are a key indicator of the health of the stock market. Strong earnings growth can boost market expectations, while weak earnings can lead to lower stock prices.

- Geopolitical Events:Geopolitical events, such as wars, natural disasters, and political instability, can have a significant impact on market expectations. These events can create uncertainty and volatility in the market.

Risk and Uncertainty

Investing in the stock market involves risk and uncertainty. Market expectations can change rapidly, and actual market performance may deviate from expectations. Investors should be aware of the risks involved and diversify their investments accordingly.

Behavioral Biases

Behavioral biases can influence investor decision-making and lead to deviations from rational expectations. Common behavioral biases include:

- Confirmation Bias:The tendency to seek information that confirms existing beliefs.

- Overconfidence:The belief that one has more knowledge or skill than they actually do.

- Herd Mentality:The tendency to follow the crowd, even when it is not in one’s best interest.

Market Efficiency

The stock market is generally considered to be efficient, meaning that it reflects all available information. This implies that it is difficult to consistently outperform the market by buying and selling stocks based on market expectations. However, market anomalies, such as value investing and momentum investing, suggest that there may be opportunities to generate excess returns.

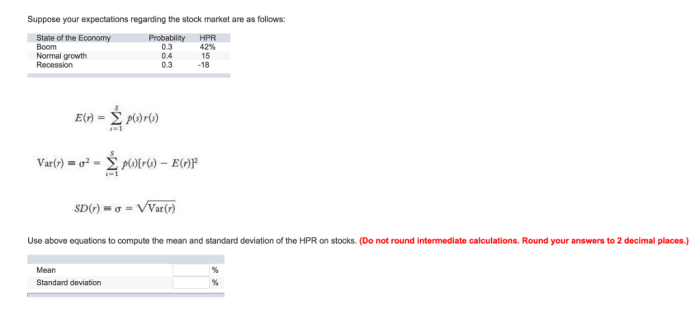

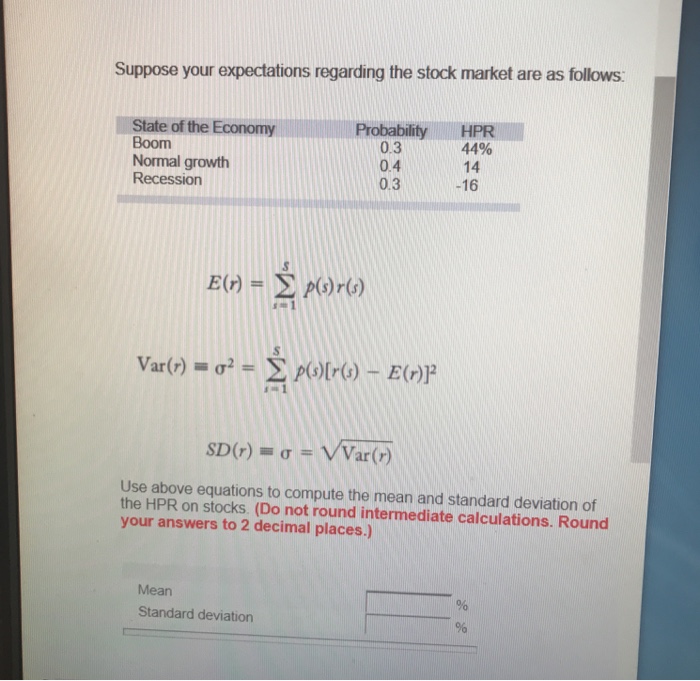

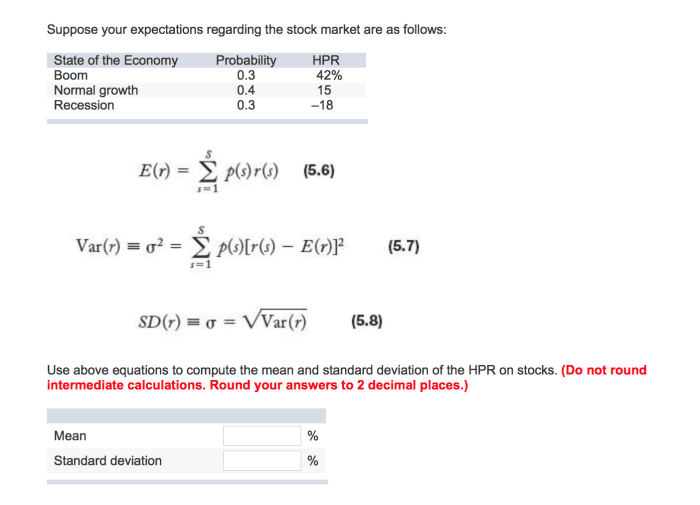

Forecasting Techniques, Suppose your expectations regarding the stock market are as follows

Various forecasting techniques are used to predict stock market performance. These techniques include:

- Technical Analysis:The study of historical price data to identify patterns and trends.

- Fundamental Analysis:The analysis of a company’s financial statements and other factors to assess its value.

- Econometric Models:The use of statistical models to predict economic and financial variables.

Ethical Considerations

Using market expectations to guide investment decisions raises ethical considerations. Insider trading, which involves using non-public information to trade stocks, is illegal. Investors should also be aware of the potential for market manipulation, where individuals or groups attempt to artificially influence stock prices.

Clarifying Questions: Suppose Your Expectations Regarding The Stock Market Are As Follows

What are the key factors that influence expectations for the stock market?

The key factors that influence expectations for the stock market include the recent performance of the stock market, the current economic climate, the expectations of other investors, and the actions of central banks.

What are the risks and uncertainties associated with investing in the stock market?

The risks and uncertainties associated with investing in the stock market include the risk of losing money, the risk of inflation, and the risk of market volatility.

What strategies can investors use to manage risk and mitigate uncertainty?

Investors can use a number of strategies to manage risk and mitigate uncertainty, including diversification, asset allocation, and hedging.